Understanding how money flows in and out of a SaaS business is super important. But it can get tricky, especially when it comes to recognizing revenue. If you are running a SaaS company or planning to start one, this guide will help you understand SaaS revenue recognition in a way that is simple, practical, and useful for 2025.

What Is Revenue Recognition?

Revenue recognition is the process of recording income in your financial books only when it is truly earned—not just when the money hits your account.

In simple words:

💡 You earn revenue when you deliver the service, not when the customer pays.

This is especially important in the SaaS (Software as a Service) world, where customers often pay upfront for services delivered over time—monthly, quarterly, or annually.

Let’s understand with an example:

- A customer buys a 12-month SaaS plan in January and pays $1,200 upfront.

- You cannot count all $1,200 as January revenue.

- Instead, you recognize $100 per month for 12 months, as each month of service is delivered.

Key points to remember:

- Recognize revenue only after delivering the promised service.

- Use this method to ensure your finances reflect reality.

- Helps in accurate reporting, forecasting, and compliance.

This approach makes your SaaS business look more trustworthy and stable in the long run.

Why Does Revenue Recognition Matter for SaaS?

In the SaaS world, where customers often pay upfront for long-term access, recognizing revenue at the right time is crucial. It is not just about counting money — it is about understanding when that money is truly “earned.”

Here is why revenue recognition is so important for SaaS businesses:

- Gives a Clear Picture of Business Performance

Recognizing revenue correctly helps you track how much you are truly earning over time — not just how much cash you received. - Ensures Transparency with Stakeholders

Investors, board members, and other stakeholders rely on your financial reports. Accurate revenue recognition builds trust by showing a fair, honest snapshot of your business. - Keeps You Compliant

Following proper revenue recognition rules (like ASC 606) helps you avoid legal or audit troubles down the line. - Helps with Better Decision-Making

When your revenue data is accurate, you can plan your growth, budget spending, and allocate resources more confidently. - Prevents Misleading Financial Reports

Recognizing future payments too early can make your business look like it is growing faster than it really is. This can lead to overspending or scaling too soon.

Proper revenue recognition keeps your business grounded in reality — and that is key for long-term success.

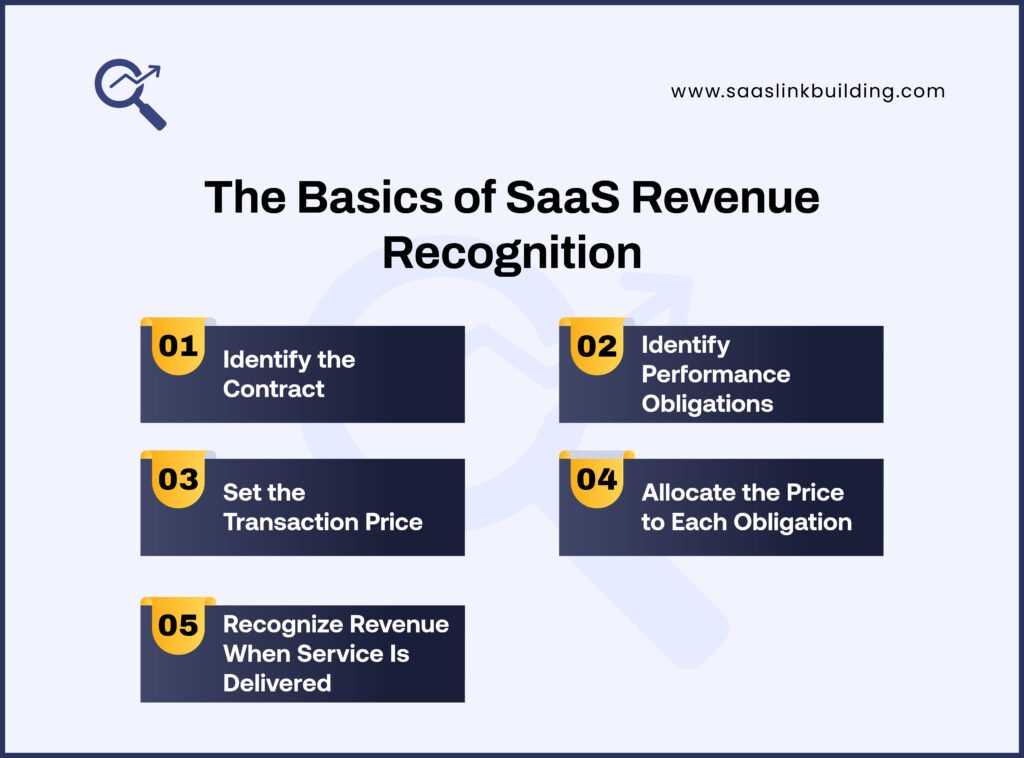

The Basics of SaaS Revenue Recognition

The rules have not changed much in 2025, but businesses are more aware now. Let us break it down step by step.

1. Identify the Contract

You need a clear agreement with your customer. This can be:

- A signed subscription form

- Online terms and conditions they agreed to

- An invoice accepted by the customer

The contract should clearly show:

- What the customer is buying

- How much it costs

- The time period of the service

2. Identify Performance Obligations

A performance obligation is a promise to deliver a service. In SaaS, this usually means giving access to your software.

If you bundle extra services like onboarding, training, or support, you may need to separate those and recognize them at different times.

3. Set the Transaction Price

This is the total amount you expect to get from the customer. Make sure to consider:

- Discounts

- Coupons

- Promotional offers

Be clear on what the actual revenue will be after these adjustments.

4. Allocate the Price to Each Obligation

If there are multiple things promised in the contract, divide the total amount across them. For example:

- Software access: 900 dollars

- One-time training: 300 dollars

You need to recognize each part separately, based on delivery.

5. Recognize Revenue When Service Is Delivered

This is the final step. You recognize revenue only when the service is provided.

- Monthly plans: Recognize every month

- Annual plans: Spread it across 12 months

- One-time services: Recognize once they are done

Getting revenue recognition right shows your business is honest and reliable. In 2025, it is a simple way to stay clear and build trust.

What Makes SaaS Revenue Recognition Different?

SaaS businesses have a unique way of earning and reporting revenue. Unlike traditional models that recognize revenue upon sale, SaaS companies must spread income over time. Here’s what makes it different:

- Recurring Payments

- SaaS operates on subscriptions, which means income comes regularly (monthly, quarterly, or annually).

- Revenue needs to be tracked over each period, not just when a payment is received.

- Upfront Payments

- Customers often pay for the entire year in advance.

- This payment cannot be fully counted as revenue immediately. Most of it is treated as deferred revenue and recognized gradually.

- Upgrades and Downgrades

- Customers might change their plans mid-cycle (e.g., from Basic to Premium or vice versa).

- Revenue schedules need to be adjusted accurately to reflect these changes.

- This affects both recognized and deferred revenue.

- Churn and Cancellations

- When a customer cancels, revenue recognition must stop for the unused period.

- In some cases, refunds may be needed.

- Churn impacts future revenue forecasts and actual income.

- Free Trials and Discounts

- Revenue recognition may be delayed or lowered during free or promotional periods.

- Accurate tracking is essential to avoid overstating revenue.

SaaS revenue needs to be earned and reported over time—matching the delivery of the service, not just the payment date.

Tools That Help With Revenue Recognition

Recognizing revenue correctly is crucial for SaaS companies. It keeps your books clean and helps you stay compliant with financial regulations. Luckily, there are smart tools that simplify this process, especially as revenue models become more complex.

Here are some of the top tools helping SaaS businesses with revenue recognition in 2025:

Chargebee

- Automates subscription billing and invoicing

- Handles revenue recognition schedules

- Offers detailed revenue reporting for finance teams

SaaSOptics (Maxio)

- Tracks deferred and earned revenue

- Ensures compliance with ASC 606 and GAAP

- Integrates with accounting platforms and CRMs

Zuora

- Ideal for enterprise SaaS billing and subscriptions

- Supports custom pricing models and usage-based billing

- Automates revenue recognition across complex deals

QuickBooks (with add-ons)

- Still a strong choice for small SaaS businesses

- Add-ons like SaaSOptics or Synder help with revenue scheduling

- Syncs well with bank feeds and invoicing systems

When choosing a revenue recognition tool, make sure it can:

- Automate recognition schedules and journal entries

- Handle changes to contracts, upgrades, or cancellations

- Seamlessly integrate with your CRM and billing tools

- Generate audit-ready financial reports

Using the right tools not only saves time but also reduces the risk of financial errors.

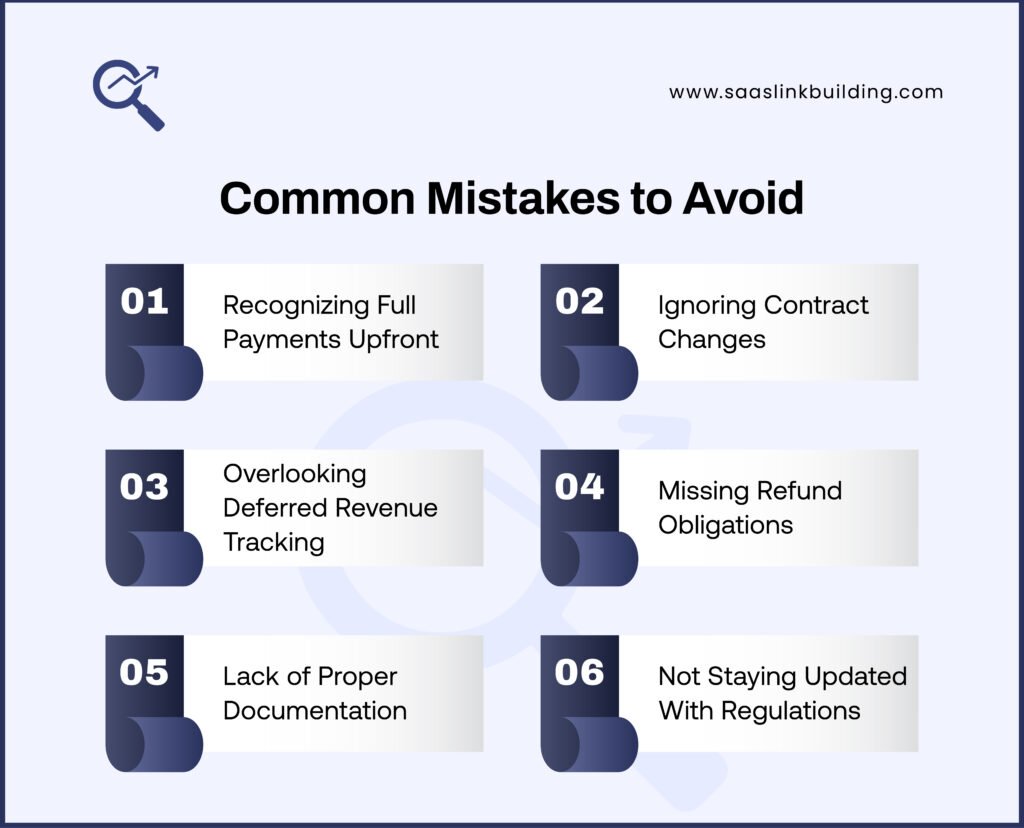

Common Mistakes to Avoid

Many SaaS companies, especially in their early stages, often make mistakes that can lead to financial confusion or compliance issues. Here are key pitfalls to avoid:

- Recognizing full payments upfront

Do not record the entire payment as revenue immediately. Spread it over the service period. - Ignoring contract changes

Failing to account for upgrades, downgrades, or cancellations can distort revenue figures. - Overlooking deferred revenue tracking

Deferred revenue must be accurately recorded and reported as a liability until earned. - Missing refund obligations

If customers are eligible for refunds, you must account for that in your revenue reporting. - Lack of proper documentation

Always maintain clear records of customer contracts, renewals, and billing terms. - Not staying updated with regulations

SaaS accounting rules evolve. Stay compliant with standards like ASC 606.

Make sure your books reflect the real flow of money and services.

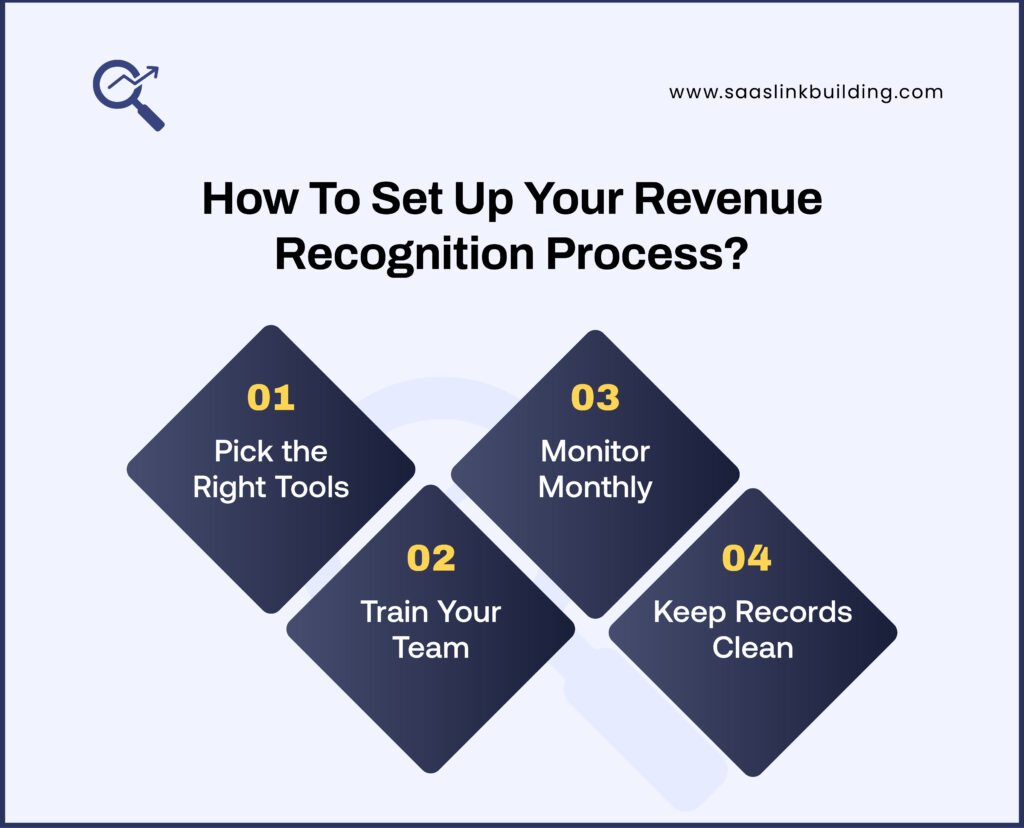

How To Set Up Your Revenue Recognition Process?

Setting up a solid revenue recognition process helps you stay compliant and avoid financial surprises. Here is a simple way to do it:

1. Pick the Right Tools

Start with the right accounting or subscription management software. Look for tools that offer:

- Automated revenue tracking

- Easy integration with your CRM and billing systems

- Clear reporting dashboards

2. Train Your Team

Everyone involved should understand how revenue recognition works—especially:

- Finance teams for compliance and reporting

- Customer success teams to align billing with service delivery

3. Monitor Monthly

Set up a monthly review routine to avoid errors:

- Check new sign-ups and active subscriptions

- Track plan upgrades, downgrades, or cancellations

- Review the deferred revenue balance and adjust entries accordingly

4. Keep Records Clean

Maintain organized and accessible records:

- Customer contracts and service agreements

- Invoices and payment history

- All customer communications related to billing

📌 Bonus Tips

- Use a shared document or dashboard to track changes in revenue monthly

- Automate alerts for subscription changes or renewals

- Review your recognition rules quarterly to match any changes in pricing or services

By following these steps, you can avoid compliance issues and get a clear picture of your business health.

Real-Life Example: A SaaS Business in Action

Let us take a simple example of a fictional SaaS startup called CloudBox. This company offers cloud storage services for teams. Here’s how CloudBox manages its revenue using proper SaaS revenue recognition practices:

- January Signups:

- 10 users sign up for a yearly plan

- Each plan costs 100 dollars

- CloudBox receives 1,000 dollars upfront

- Revenue Recognition Rule:

- CloudBox cannot record the full 1,000 dollars in January

- Instead, they must spread it out over 12 months

- So, they recognize 83.33 dollars every month

- Revenue Schedule Example:

- January: 83.33

- February: 83.33

- …

- December: 83.33

- Tracking Tool:

- They use Chargebee, a subscription management platform

- Chargebee automates revenue tracking and helps with adjustments

- What Happens If a User Cancels?

- Say one user cancels in July

- CloudBox immediately adjusts the remaining schedule

- Only the used portion (January to July) is recognized

- The unused portion (August to December) is not recognized

This process ensures CloudBox follows correct accounting practices, avoids overreporting revenue, and stays compliant with financial regulations.

Tips To Make It Easier in 2025

SaaS revenue recognition may not sound exciting, but it plays a key role in building trust, staying compliant, and making smart business decisions. Here are some simple tips to make it easier in 2025:

- Use software, not spreadsheets

Spreadsheets are prone to errors and hard to manage at scale. Use SaaS accounting tools like Chargebee, QuickBooks, or Xero to automate calculations and keep everything organized. - Review contracts carefully

Every SaaS contract is different. Pay close attention to:- Contract length

- Payment terms

- Renewal clauses

- Performance obligations

This helps you recognize revenue correctly and avoid legal issues.

- Be consistent every month

Set a regular process to recognize revenue. Automate monthly entries to stay compliant with standards like ASC 606. Avoid last-minute adjustments that may cause confusion. - Work with a finance expert

Hire or consult with someone who understands SaaS finance. They can:- Guide you through complex rules

- Set up proper systems

- Help with audits or investor questions

- Keep documentation ready

Maintain clear records of every contract, invoice, and revenue schedule. This helps during financial reviews and improves internal accountability. - Educate your team

Make sure your sales, finance, and product teams understand how revenue recognition works. It helps prevent mistakes before they happen.

Following these tips can make your revenue processes smoother and your business more reliable in 2025.

📈 Want to grow your SaaS business the smart way?

Understanding revenue recognition is just one piece of the puzzle. If you’re also looking to boost brand visibility, drive traffic, and attract high-intent users, then marketing plays a major role. Check out our complete SaaS marketing guide to learn how SEO, content, and link building can power your growth in 2025.

Final Thoughts

In SaaS, how you recognize revenue matters more than ever. Investors, partners, and even your team rely on accurate numbers. You do not need to be a finance pro to get it right. Just stay consistent, use the right tools, and understand the basics.

Revenue is not just money in the bank – it is about delivering value over time. So take the time to do it right. Your business will thank you for it.

FAQs

Q1. What is SaaS revenue recognition?

Ans. SaaS revenue recognition is the process of recording income only when the service is delivered, not when the payment is received. If a customer pays for a year upfront, the revenue is spread monthly across the year.

Q2. Why is revenue recognition important in SaaS?

Ans. It helps:

- Show the real financial health of the business

- Stay compliant with accounting standards like ASC 606 or IFRS 15

- Avoid over-reporting income in a single period

Q3. What is ASC 606 and how does it apply to SaaS?

Ans. ASC 606 is an accounting standard that tells businesses when and how to recognize revenue. For SaaS, this means recognizing revenue over time as the service is provided, not upfront.

Q4. Can I recognize all revenue when I get paid?

Ans. No. Even if a customer pays upfront, you must recognize the revenue gradually as you deliver the service—usually monthly.

Q5. What happens if a customer cancels mid-subscription?

Ans. You stop recognizing future revenue and may need to adjust previous entries depending on your refund policy.

Q6. Is deferred revenue the same as recognized revenue?

Ans. No.

- Deferred revenue is money received but not yet earned.

- Recognized revenue is income that has been earned and recorded.